Here are some hard facts about the current state of driving:

Auto insurance rates are rising the fastest we have ever witnessed going back to 1981.

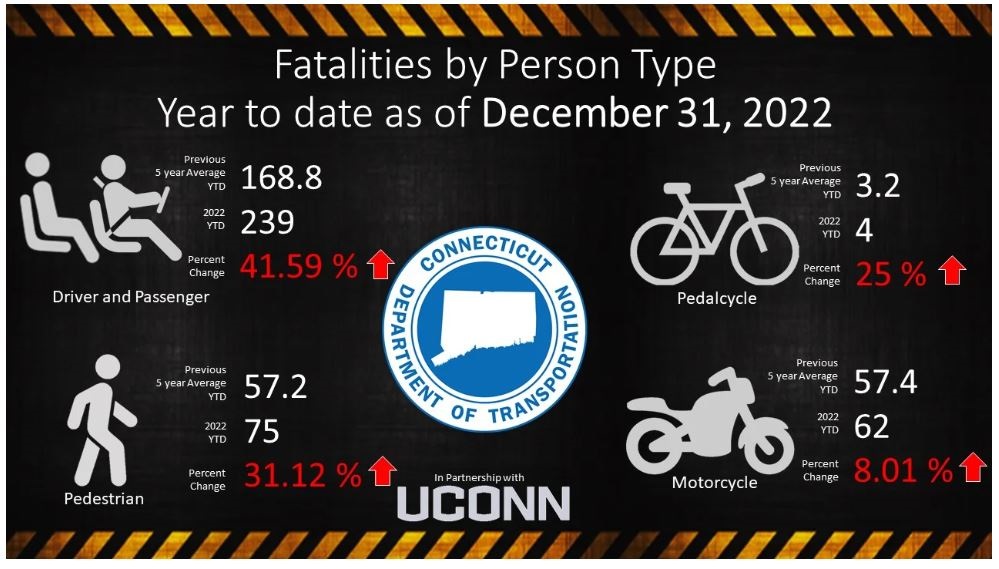

Some alarming data out from CT DOT on 2022 Fatalities in CT: The post Covid return to “normal” has accelerated frequency and severity largely influenced by distracted driving.

The latest info from the National Highway Traffic Safety Administration (NHTSA) for 2019 said it studied crashes in calendar year 2019 that killed an estimated 36,500 people, injured 4.5 million and damaged 23 million vehicles. Traffic crashes in the US cost society $340 billion in one year, or just over $1,000 for each of the country’s 328 million people, according to a study by safety regulators. (read that again!!)

This is an important time to be aware of not only your Auto Liability Limits but also your Uninsured and especially Underinsured Motorists limits. Do you have the broader Underinsured Motorists Conversion endorsement that locks in your policy limit?

Connecticut drivers have a pretty unique car insurance coverage option called “underinsured motorist conversion coverage,” which offers additional protection after a car accident with an at-fault driver who isn’t carrying sufficient liability insurance. Feeling good about living in Connecticut now?!

The fact of the matter is that the cost of reinsurance and the continued cost of labor and materials have an impact on all business from inflation and rising interest rates.

Any questions please reach out to Keating Agency Insurance at 860.521.1420